A team of researchers from Financial System Department at SGH Warsaw School of Economics has published in the prestigious Journal of Financial Stability the results of a study on the contagion effect on financial markets due to extreme events.

Research on contagion on financial markets has been conducted for nearly three decades. Due to the outbreak of the global financial crisis in 2008, which strongly affected both developed and emerging markets, the number of studies in this area increased significantly. The global SARS-CoV-2 pandemic triggered another crisis in 2020 – its analyses are still in the early stages, but the first conclusions can already be drawn.

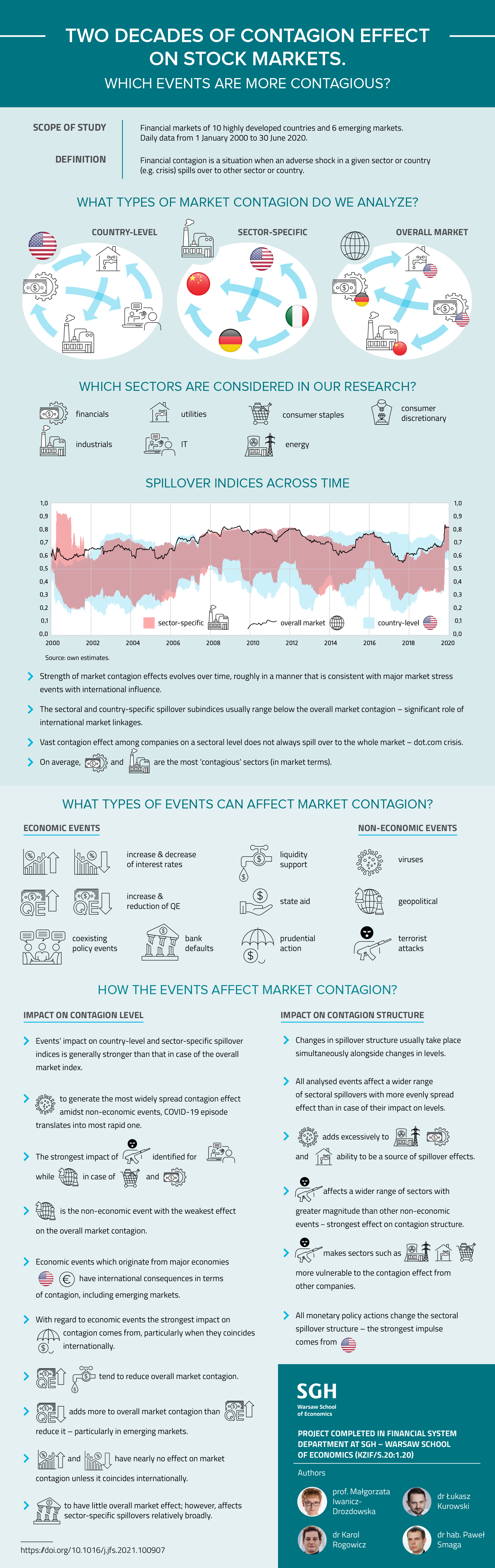

The study "Contagion effect on financial markets due to extreme events" was conducted in the Financial System Department of SGH Warsaw School of Economics by a team led by prof. Małgorzata Iwanicz-Drozdowska, composed of dr Łukasz Kurowski, dr Karol Rogowicz and dr hab. Paweł Smaga. Its aim was to examine the impact of different types of economic and non-economic events on the contagion effect on financial markets - and in particular stock markets - in developed and emerging countries. The study focuses on market reactions to major events of the past two decades, mainly from the US and the Eurozone.

The research team traced - using so-called contagion indices - how contagion occurs in the "broad" market and at the country- and sector-levels. In particular, the level and structure of this effect was analysed. The main objective of the study was to answer the question of how different types of events affect contagion between countries and sectors. The following research questions were formulated:

Do various economic and non-economic events:

(1) affect the overall level of contagion on the financial markets?

(2) cause a contagion effect at country or sector level?

(3) influence the structure of the contagion effect?

There is no consensus in the literature on the definition of the contagion effect on financial markets. In general, it is the spread (e.g. across sectors or countries) of adverse shocks that can increase asset price volatility, price drops and even lead to financial crises. For the purposes of the study, the contagion effect was defined as asset price volatility moving from one location to another. Three types of contagion effect were analysed: national, sectoral and global. The following economic sectors were analysed: financials, industrials, IT, utilities, both consumer staples and discretionary, energy.

The study used market data (for 10 developed markets and 6 emerging markets) and a database of approximately 300 major economic and non-economic events covering the period from January 2000 to the end of June 2020. The researchers analysed indices at the level of the countries concerned and for the sectors indicated above. Among the economic events (from the US and the eurozone) a total of 16 event types were included, covering monetary policy, changes in prudential regulation, international bank problems, and government bailouts. Events with a geopolitical dimension, terrorist attacks and pandemics were included in the group of non-economic events. In addition, the researchers identified as many as 49 co-occurring events, i.e. situations where several events occur at the same time.

A topic still underrepresented in the literature is the comparison of the contagion effect of the COVID-19 pandemic (in terms of magnitude and structure) with the impact of other types of events. The pandemic effects on financial market are sometimes compared with the global financial crisis, even though the origins and transmission mechanisms of the two types of crises are different. For this reason, it has proved a challenge to compare the wide range of market impacts of events, rank them and place COVID-19 among them.

According to the results, the impact of events on the contagion effect at country- or sector--level was found to be stronger than the overall market impact. However, the strength of this effect varies depending on the market conditions in which the event under study takes place, i.e. whether the contagion effect was at a low or high level when it occurred. Out of the non-economic events, epidemics have the strongest impact on contagion on markets. In the case of the COVID-19 coronavirus pandemic, the contagion effect took a very rapid course. Terrorist attacks affect contagion most strongly in IT sector, while geopolitical events affect the financial consumer staples sector. Among non-economic events, the impact on the overall market contagion effect is lowest for geopolitical events.

Economic events originating in the two largest economies, namely the US and the eurozone, affect the contagion effect internationally, including the developing economies. Among economic events, prudential measures have the strongest impact, above all the ones that co-occur internationally. In turn, quantitative easing and liquidity support limit the overall market contagion effect. It is worth noting that the quantitative easing conducted by the main central banks (i.e. the Federal Reserve and the European Central Bank) also affects the contagion effect on emerging markets, while liquidity support remains without significant impact on this effect. Bank defaults, on the other hand, have little effect on the overall market contagion effect, but are already relatively strong and sector-wide.

Changes in the structure of the contagion effect often follow a change in its level. Epidemics make the energy, financial, utilities sectors to become a much more serious sources of contagion for other sectors. Furthermore, terrorist attacks change the structure of market contagion to the greatest extent - they infect a much larger group of sectors than other events. The vulnerability of the energy, consumer staples and utilities sectors to contagion from other sectors is then also increased.

The results of the study are presented in the article 'Two decades of contagion effect on stock markets: Which events are more contagious', which appeared in the Journal of Financial Stability (Vol. 55, August 2021).